Blog

Updated : April 17th, 2025

Is Your Car Worth Fixing, or Should You Simply Replace It Instead? Continue reading

Updated : December 17th, 2024

Clean Titles and Title Washing in Vehicle Documentation Continue reading

Updated : December 02th, 2024

Branded Title: A Comprehensive Guide to Types and Considerations Continue reading

Updated : January 05th, 2025

What Is a Car Title: Definition, Purpose, and Key Information Continue reading

Updated : February 13th, 2025

Top 5 Car Brands Involved in the Most Fatal Accidents

Updated : February 16th, 2025

How to Junk a Car With Expired Registration

Updated : February 11th, 2025

Is it Safe to Drive My Wrecked Car After an Accident?

Updated : February 13th, 2025

How Many Junk Cars are You Allowed to Own?

Updated : February 13th, 2025

15 Highest Paying Junk Cars to Get More Cash

Updated : February 10th, 2025

What Happens If Your Friend Crashes Your Car — Who is Guilty and Who Will Pay?

Updated : February 12th, 2025

10 Most Hated Car Brands in the World

Updated : February 14th, 2025

Should You Repair a Salvage Car? All That You Need to Know

Updated : February 15th, 2025

How to Sell a Salvage Title Car?

Updated : January 26th, 2025

Fixing Your Car's Undercarriage: All You Need to Know About Costs

Updated : February 12th, 2025

The Most Crashed Cars In America (with Statistical Data)

Updated : October 24th, 2023

Top 10 Most Dangerous Cars In the World and Reasons to Call Them That

Updated : February 10th, 2025

Who Pays the Most Money for Junk Cars in the US?

Updated : March 12th, 2025

Salvage vs. Rebuilt Title: What Are the Differences?

Updated : March 29th, 2025

Electric Car Motor Lifespan: How Long Does It Last?

Updated : January 26th, 2025

Clicking Sound When Trying to Start the Car: What It Means and What Are the Main Causes?

Updated : February 09th, 2025

Engine Rebuild Cost: Is Rebuilding an Engine Worth It?

Updated : February 07th, 2024

13 Popular US Cars That Will Depreciate the Most in 2022

Updated : February 07th, 2024

10 Worst Rated Cars in 2021

Updated : March 09th, 2025

13 Most Problematic US Cars Made in 2016-2021

Updated : February 16th, 2025

Toyota Prius Battery Replacement: How Much Does it Cost and Is it Worth It

Updated : February 13th, 2025

What to Do With a Totaled Car With No Insurance

Updated : February 13th, 2025

Signs and Causes of a Blown Engine and Costs of Repair

Updated : January 26th, 2025

How Much Does Car Suspension Repair Cost?

Updated : February 12th, 2025

When It Isn’t Worth Replacing a Car Engine

Updated : February 16th, 2025

Car Makes Grinding Noise While Accelerating and Driving at Low Speeds: Reasons and Fixes

Updated : January 26th, 2025

Diagnosing and Fixing Rattling Noises in Your Car

Updated : February 13th, 2025

Cracked Engine Block: Symptoms, Causes and Repair Tips

Updated : February 16th, 2025

5 Leaking Differential Symptoms & How to Fix

Updated : February 10th, 2025

Should You Have Insurance on Your Non-running Car?

Updated : March 12th, 2025

Car Shuts Off While Driving: What Do You Need to Know?

Updated : February 16th, 2025

10 Extremely Hard US Cars to Work On

Updated : February 16th, 2025

5 Best Ways of Selling a Car with Mechanical Problems

Updated : February 13th, 2025

How Much Would a Junkyard Pay for My Car?

Updated : January 16th, 2023

Complete Guide of How to Sell a Broken Down Car for Cash Continue reading

Updated : February 15th, 2025

What is the Salvage Value of Your Car and How to Calculate It

Updated : October 14th, 2023

Top 8 Symptoms You Used the Wrong Transmission Fluid

Updated : February 12th, 2025

What Happens to the Value of My Car After an Accident?

Updated : February 16th, 2025

Let’s Think About Ecology Together: Junk Your Car for Cash Today

Updated : February 16th, 2025

3 Things to Know About Junking a Car With Expired Registration

Updated : March 29th, 2025

How to Sell a Car With a Title Loan: All You Need to Know

Updated : February 16th, 2025

12 Common Car Problems. List of Major & Minor Car Issues

Updated : March 24th, 2022

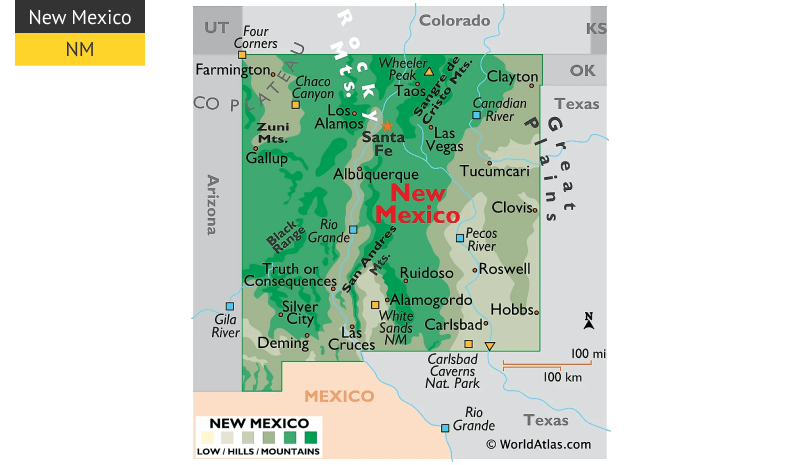

How to Transfer a Car Title in New Mexico![How to Transfer a Car Title in New Jersey [Ultimate Guide] How to Transfer a Car Title in New Jersey [Ultimate Guide]](https://junkcarsus.com/files/articles_resized/800x465-new-jersey.800x465.png)

Updated : March 24th, 2022

How to Transfer a Car Title in New Jersey [Ultimate Guide]

Updated : March 24th, 2022

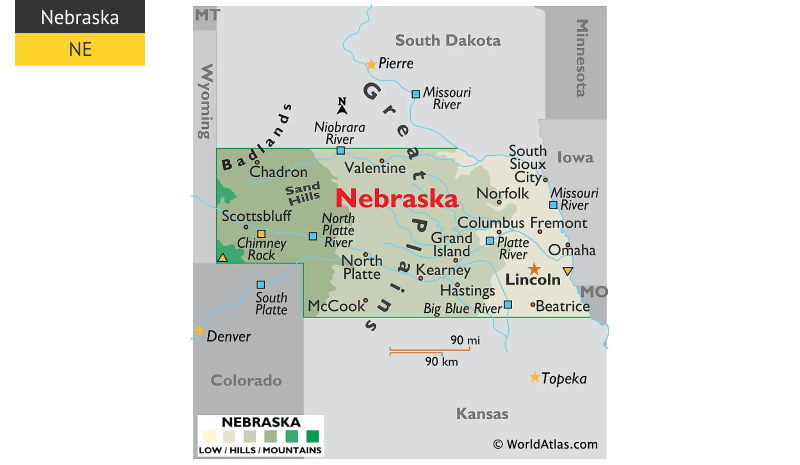

How to Transfer a Car Title in Nebraska

Updated : February 07th, 2024

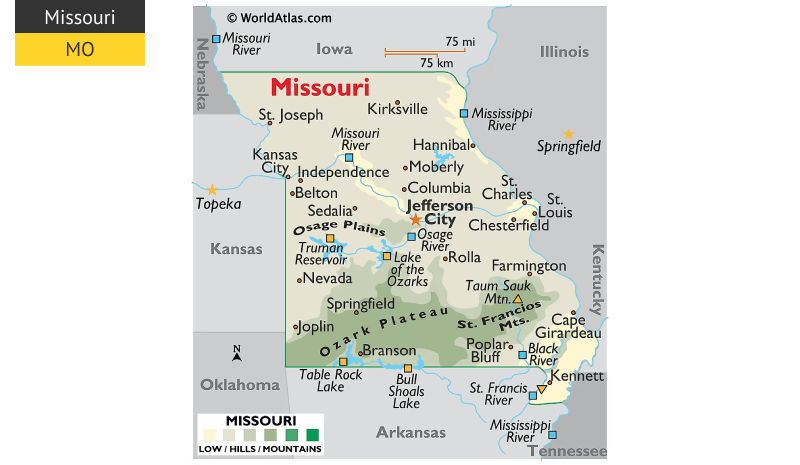

How to Transfer a Car Title in Missouri

Updated : March 24th, 2022

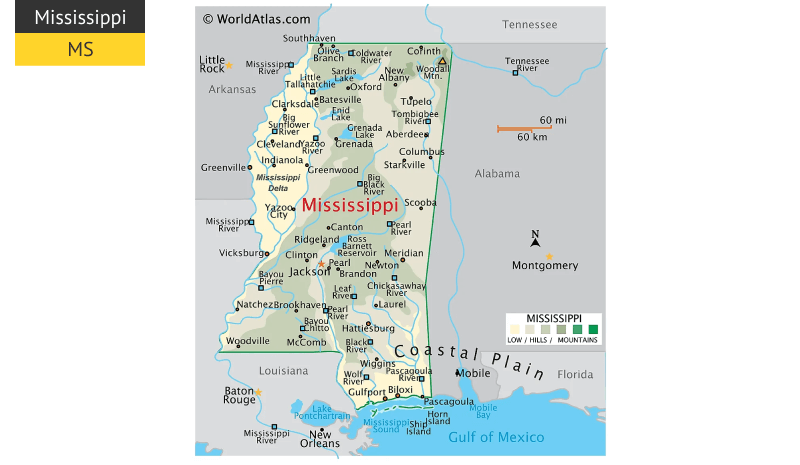

How to Transfer a Car Title in MississippiFind out what your junk car is worth in seconds. Fil out the information below: